UPDATE: Please find the NEW 2023 CONFORMING LOAN LIMITS UPDATED HERE.

Conforming and FHA loan limits are increasing for 2021. The higher mortgage limits will allow home buyers to qualify for more when needed. Below we will break down the latest 2021 loan limits.

Please contact Coast2Coast Lending 7 days a week with questions by calling the number above or just submit the Quick Request Form on this page.

Conforming Loan Limits 2021:

In most of the country, the 2021 maximum conforming loan limit for 1-unit single-family properties will be $548,250. This is nearly a 7.5% increase from last year’s loan limit of $510,400. The FHFA’s loan limits define the maximum amount that Fannie Mae and Freddie can finance for a one-unit single-family home. The loan limits increase for muti-unit properties as seen in the chart below.

In more “high cost” markets such as California and New York, the new limit will be as high as $822,375, up from $765,000 last year.

Please find the complete 2021 Conventional loan limit chart here.

These new loan limits are effective on or after January 1, 2021. This is the fifth loan limit increase in the last five years, and it will take effect in most locations in the U.S., with the exception of 47 specific counties or county-equivalents.

| Units | Contiguous States (Most States) | High Cost |

| 1 | $548,250 | $822,375 |

| 2 | $702,000 | $1,053,000 |

| 3 | $848,500 | $1,272,750 |

| 4 | $1,054,500 | $1,581,750 |

FHA Loan Limits 2021:

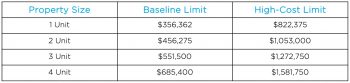

In 2021, the new FHA mortgage limit for most counties across the U.S. will go up to $356,362, this is a slight increase from the 2020 cap of $331,760.

Just like the Conforming loans above, FHA will have higher limits for designated “high-cost areas,” such as San Francisco, New York and Washington, D.C., the 2021 FHA loan limit will rise to $822,375 (up from $765,600 last year). Again, these changes will apply to FHA loans with a case number assigned on or after January 1, 2021.

Buyers can look up their county specific FHA loan limit here.

Coast2Coast is proud to serve home buyers in many states across the U.S. including Florida, Georgia, California, Texas